Real estate investing can be financially rewarding.

The potential for ongoing rental income, long-term appreciation, and deductions for non-cash expenses like depreciation—which can shield income from taxation1—are just several upsides unique to the asset class.

However, becoming a landlord can be a significant time sink. Data from property management software company DoorLoop reveals that landlords spend anywhere between four and 40 hours per month managing their rentals.2 Scale that up to several units, acquire one or two new properties a year, and sprinkle in a rehab project every once in a while, and real estate investing can rapidly become a second full-time job.

So, how can you gain exposure to real estate without the headaches and significant time—and financial—commitment of becoming a landlord?

One possible alternative is passive real estate investing, which involves making debt or equity investments in real estate without having to engage in the day-to-day work of acquiring, maintaining, leasing, operating, or selling properties.3

In a passive real estate arrangement, you provide capital to a sponsor or fund manager. These professionals then deploy your capital into one or more real estate deals with the objective of generating positive returns over time.

If you passively invest in real estate via publicly traded real estate investment funds (REITs), returns may come in the form of REIT dividends or appreciation in the value of your shares. If you invest in open-end private real estate funds—like one of DLP Capital’s sponsored funds—you may receive ongoing distributions in the form of preferred returns, the distribution of returns over and above the preferred return (excess distributable cash), and may see further returns as a result of appreciation when you exit your investment by redeeming your interest in the fund.

Whether public or private, passive real estate investing can unlock several compelling financial benefits. In this article, we explore these potential upsides in more detail and address some common questions about passive real estate investing.

Benefit #1: Portfolio diversification

When you invest in a passive real estate investment like a public REIT or a private real estate fund, you can gain exposure to hundreds of properties and thousands of units simultaneously. This can help mitigate the effects of specific (also known as idiosyncratic) or concentrated risks associated with any particular real estate asset, such as construction risk, tenant risk, sponsor risk, submarket risk, natural disaster risk, or financing risk.4

For example, suppose you invest all of your money in one single-family rental. Because you can only rent to a single-tenant household, your returns will hinge heavily upon whether your property is occupied, how often and how much repairs cost, and whether or not your tenant pays on time.

Now, imagine you invest in one 48-unit apartment complex via a syndicated deal. With four dozen doors, you are comparatively less exposed to concentrated tenant credit risk, since most of your rent will remain collectible even if one or two tenants default on their leases. You’ll also be less exposed to vacancy risk, since you’ll still be bringing in some rental revenue even if several units are unoccupied.

Even so, there are still undiversified risks associated with owning a single multifamily property. For instance, there may be unique issues with the building’s foundation, roof, or sceptic, electrical, or plumbing systems. There could also be idiosyncratic risks inherent with the community’s location or market—including demographic headwinds, zoning or land use risks, or oversupply risks.

Finally, suppose you allocate to a private real estate fund or a public REIT that owns 2,000 units across 25 multifamily communities located in five different markets. This arrangement allows you to diversify away from specific tenant risks, submarket risks, and specific risks linked to individual multifamily assets.

The DLP Housing Fund, which owns 13,163 units across 55 multifamily communities in 14 Sunbelt states (based on internal data as of March 31, 2025), provides investors with diversified exposure to attainable workforce housing while targeting double-digit net annual returns.

Benefit #2: Offset income via depreciation*

Real estate is unique in that investors can deduct deprecation charges against net operating income, which can reduce taxable income.1 According to IRC Section 168, the purchase price of residential rental property, less the cost of land, may be depreciated on a straight-line basis over a 27.5-year period—that is, at a rate of 3.636% per year.5

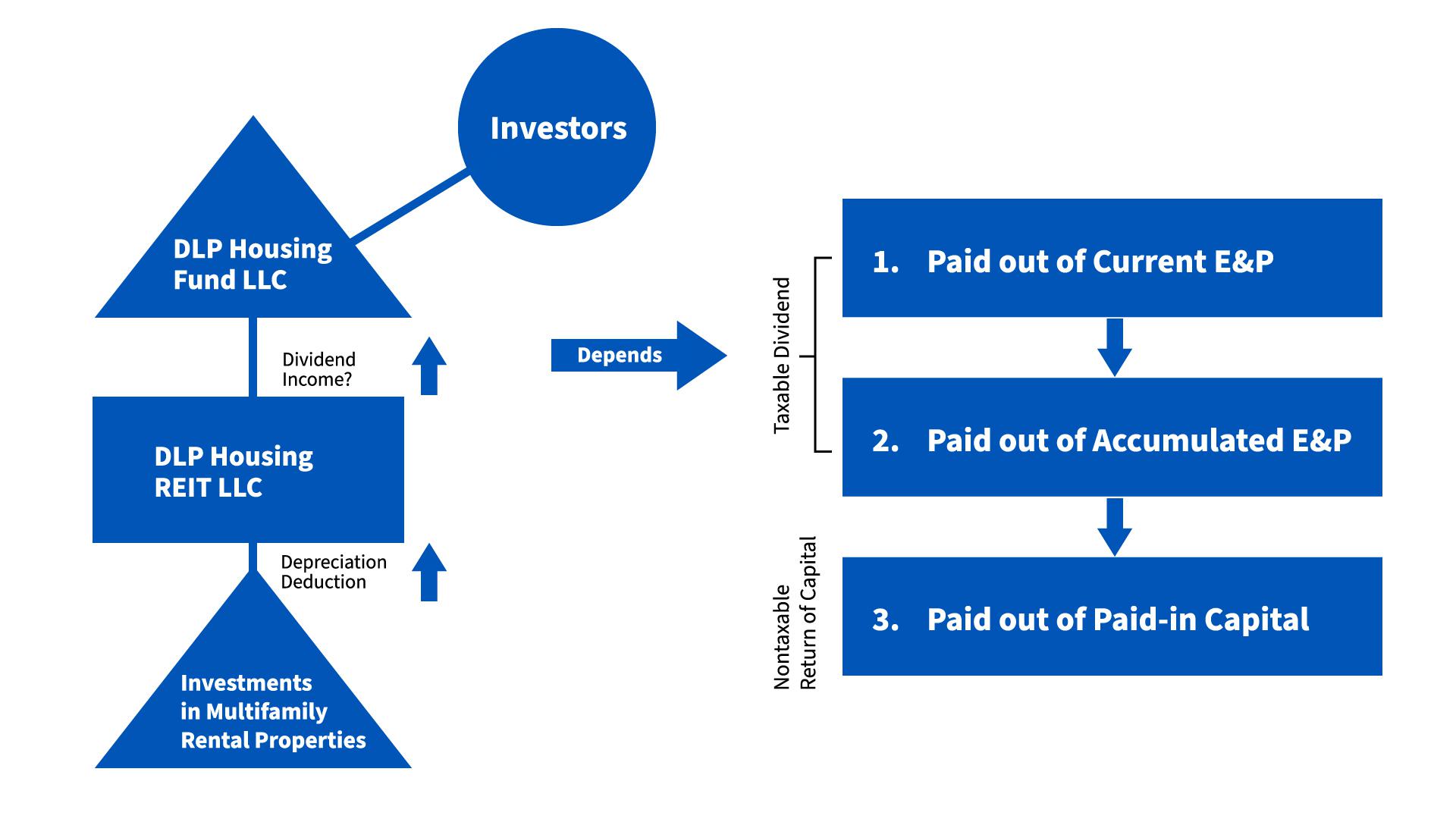

Sophisticated fund managers can perform cost segregation studies on their holdings to identify property elements that can be depreciated over shorter five-, seven-, or 15-year periods; this allows fund managers to accelerate or frontload depreciation deductions, thereby deferring income taxes and increasing near-term cash flow.6

Source: DLP Capital

Since inception in January 2020, all ordinary income earned by the DLP Housing Fund has been offset by depreciation and distributed to investors as a nontaxable return of capital.1

Benefit #3: Ongoing income

Investing in passive private real estate funds or public REITs can offer you the potential to earn monthly or quarterly rental or interest income.

When you invest with DLP, you have the potential to receive preferred returns. Unlike exchange-traded REITs, a private real estate fund’s income is typically first distributed to investors until a return target is met. Only then do the fund’s managers receive performance fees. Asset management fees, however, are typically assessed regardless of whether a fund achieves its preferred return,

DLP is a little different: all of our fees are subordinate to the investor’s preferred return. This means that all distributable income goes to meet your preferred return before you pay either performance fees or the 2% annual asset management fee.**

While neither preferred returns nor distributions above the preferred return target are guaranteed—all returns hinge upon a fund’s performance—this arrangement keeps your fund management team’s incentives aligned with your own and, uniquely, ensures that your returns receive precedence over others.

The DLP Capital Preferred Credit Fund targets a 9% annual preferred return distributed monthly—the highest of any DLP Capital sponsored fund.