Maximizing Wealth: Best Ways to Earn Passive Income

Accredited investors can earn passive income from private real estate. But there are other options, too.

Maximizing Wealth: Best Ways to Earn Passive Income

Accredited investors can earn passive income from private real estate. But there are other options, too.

Want money? You’ll have to earn it.

At least, that’s the case for a vast, vast majority of people. In 2025, an estimated 83.6% of Americans aged 25 to 64 are employed.1 For nearly all of them, active income—the money they derive from working a job—makes up the lion’s share of their earnings.

Earning money without having to work sounds ideal, but it’s also fairly rare. According to the New York Times and the U.S. Census Bureau, only about 20% of Americans earn any kind passive income, whether from rents, dividends, interest, or royalties.2,3 Among those who do, median passive earnings stand at roughly $4,200 per year.2,3

But if you want to retire, downshift your career, supplement your active income, or become financially independent, you’ll need to find ways to generate passive income. And if you want to sustain your lifestyle indefinitely without spending down your wealth over time, you may need a significant amount of passive income. But what investments are best for earning passive income, and which ones are right for you?

Earn passive income with private real estate funds

You’ve probably given some thought to becoming a real estate investor. Or perhaps you’re currently a landlord. But between the late-night maintenance calls, the never-ending leasing cycles, and the hassles of collecting rent, you’ve likely realized that being a landlord isn’t passive at all.

But you don’t have to buy a property outright to gain exposure to real estate. Private real estate funds, for example, allow you to invest in and earn rental income from multiple real estate properties at once. By spreading out your capital across many deals, you’re more insulated from the concentration risk that comes from putting all your eggs in one basket.

Besides, there’s nothing you need to do after selecting a private real estate investment fund. Once you invest, the fund manager takes over: they deploy your capital, vet sponsors and projects, and ensure that these sponsors and projects align with the fund’s investment objectives—whether that involves ground-up construction, property management, repositioning, or lending.

But what does this look like in practice? In simple terms, it’s essentially “mailbox money.” You receive monthly or quarterly passive income in the form of a preferred return, which means that the private real estate fund must pay you a minimum rate of return before your fund manager receives performance fees. In addition to your preferred return, you may also receive “excess distributable cash,” which can be distributed on an identical or alternative cadence with your preferred returns.3

There is one important caveat: to invest in a private real estate fund, you’ll need to be an accredited investor. This definition requires you to either have a net worth greater than $1 million, excluding the value of your primary residence, or income exceeding $200,000 individually (or $300,000 jointly with a spouse) for the current and prior two years.5

Accredited investors can earn monthly or quarterly passive income with DLP Capital- sponsored private real estate investment funds.

Publicly-traded REITs can potentially offer passive income, too

If you aren’t an accredited investor but still want to earn passive income from real estate, what alternatives can you pursue?

One option is an exchange-traded real estate investment fund (REIT), which is a company that invests in income-producing commercial real estate, such as multifamily communities, mixed-use developments, strip malls, or office buildings.

The process of investing in a public REIT is very similar to buying stock, in that you can purchase REIT shares directly with a brokerage account. The critical difference is that a publicly-traded REIT is required to distribute at least 90% of its taxable income to REIT shareholders per year.6 These dividends, which are typically paid quarterly and sometimes monthly, can serve as a source of passive income.

That said, one potential downside of REITs is that they also trade like stocks—REIT shares are volatile and fluctuate in value on a daily basis.

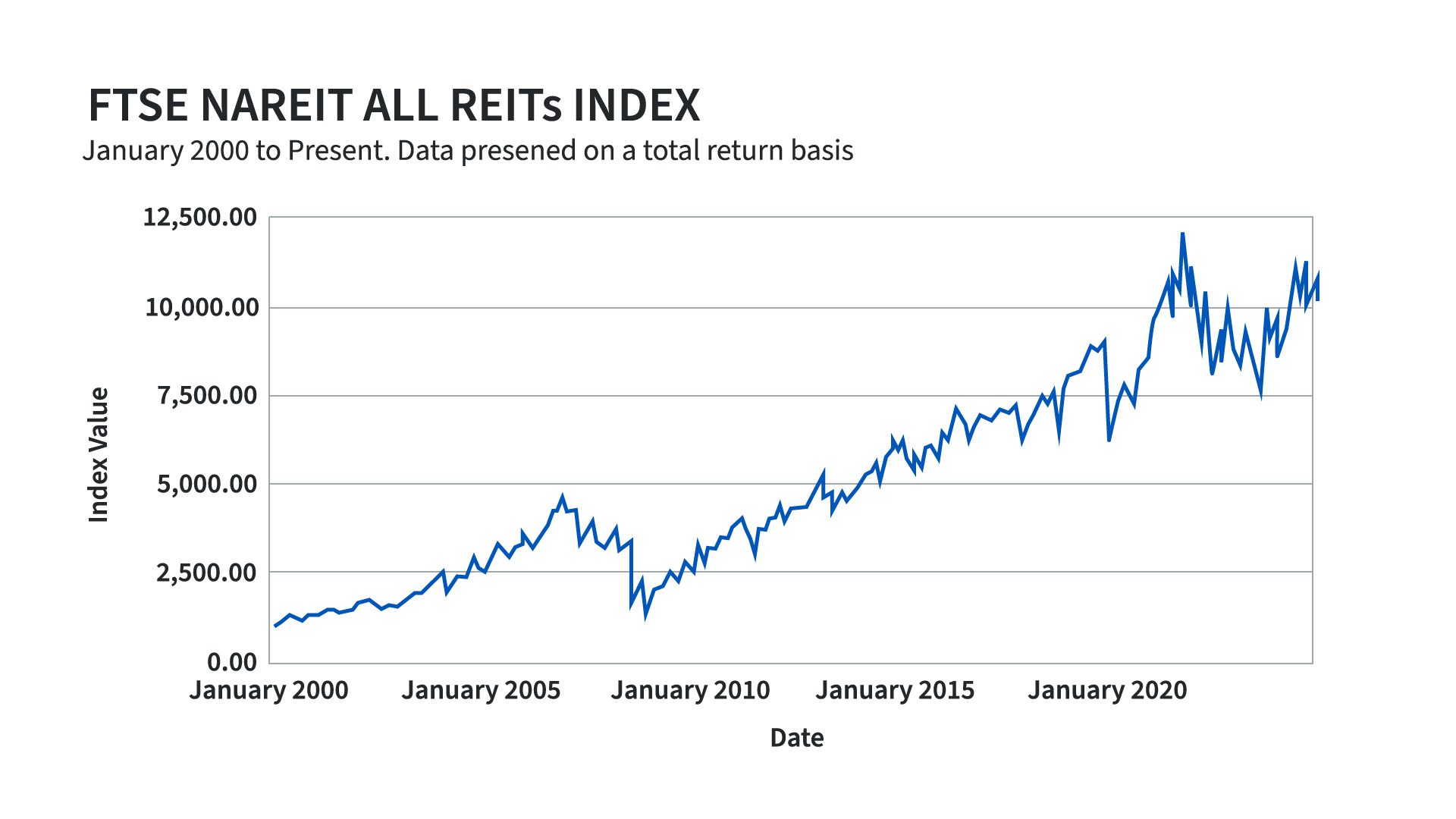

Chart Source: Monthly Index Values & Returns. FTSE NAREIT. May 2025.

For instance, consider the performance of the FTSE NAREIT All REITs index, which tracks the performance of all publicly-traded U.S. REITs. Since the 21st century, the index has suffered several significant drops:

Table source: Calculations by DLP Capital.

In fact, while the index is off its October 2023 lows, it has yet to exceed its December 2021 all-time high. This means that public REIT investors may need to be prepared for several years of potential negative returns.

Want the potential to earn passive income without the public market volatility? Since inception, investors in DLP Capital-sponsored funds have consistently earned double-digit annual returns.*

What about interest income?

Interest is another popular form of passive income. Savers can earn interest by investing in government or corporate bonds, money market instruments, or simply by accumulating money inside a high-yield savings account.

If you prefer investments that are less correlated to market fluctuations, short-term interest-bearing instruments can provide consistent returns with little to no volatility. But the upside is more or less capped at the federal funds rate set by the Federal Reserve, which currently stands at 4.25–4.50%.7 If you want higher yields, you may have to assume more credit risk or purchase longer-term bonds, which can fluctuate in value depending on prevailing interest rates and other factors.

One potential low-volatility alternative would be a private credit fund, which allows you to invest in a basket of loans that the fund makes to corporate borrowers.

For example, the DLP Lending Fund makes debt investments to experienced real estate sponsors for the construction, acquisition, and repositioning of attainable rental housing in U.S. markets where working families are being priced out of home ownership.

These first-position mortgages are backed by real estate along with personal guarantees, and may potentially allow you to earn higher yet more consistent returns.

The DLP Lending Fund has a ten-year track record of achieving double-digit annual returns for investors.*

How can I make $1,000 a month in passive income?

To make $1,000 a month in passive income, you’ll need to have some savings to start. For example, you’ll need to invest $200,000 in a hypothetical private real estate fund that meets its 6% annual preferred return target to make $1,000 a month or $12,000 a year in passive income.

How can I maximize my passive income?

You can earn passive income by investing in assets that generate income without your active involvement. Examples include private real estate funds, publicly-traded REITs, dividend stocks, and treasury securities. The key to maximizing your passive income, however, comes from scale: For example, you can participate in a dividend reinvestment program (DRIP) that automatically reinvests your preferred returns rather than distributing them to you, allowing you to invest increasing amounts of money.

How to invest $100,000 for passive income?

If you’re an accredited investor, $100,000 may be enough to invest in a private real estate equity or credit fund, though this will depend on each specific fund’s minimums. These funds can potentially provide you with passive income in the form of regular preferred return distributions. You can also invest your $100,000 in other assets like dividend-paying equities, corporate bonds, or publicly-traded REITs.

How do you grow wealth passively?

Assets like private real estate, publicly-traded REITs, dividend stocks, or interest income can help you produce passive income and grow your wealth passively.

How much passive income will $500k generate?

That depends on your portfolio’s yield. If you invest $500,000 in a hypothetical private credit fund that meets its 6% preferred return target, distributed monthly, you’ll receive $2,500 per month or $30,000 annually. On the other hand, if you put $500,000 in an S&P 500 exchange-traded fund, which currently generates an annual dividend yield of roughly 1.2%, you’ll earn about $6,000 in annual income.

1Labor Force Participation Rate - 25-54 Yrs. St. Louis Fed. May 2025.

2Income. U.S. Census Bureau. May 2025.

3What is Passive Income? It’s Not What Influencers Say It Is. The New York Times. January 2023.

4Please refer to the offering documents for a detailed description on how distribution works.

5Accredited Investors. U.S. Securities and Exchange Commission (SEC). January 2025.

6Investor Bulletin: Real Estate Investment Trusts (REITs). U.S. Securities and Exchange Commission (SEC). December 2011.

7Effective Federal Funds Rate. Federal Reserve Bank of New York. May 2025.

*PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE PERFORMANCE. INCEPTION DATE FOR DLP LENDING FUND: OCTOBER 2014.; DLP PREFERRED CREDIT FUND: OCTOBER 2021; DLP HOUSING FUND: JANUARY 2020; DLP BUILDING COMMUNITIES FUND: OCTOBER 2021.

STATEMENTS ARE THOSE OF DLP CAPITAL ONLY AND ARE NOT GUARANTEED, NOR SHOULD SUCH STATEMENTS BE RELIED UPON. FORWARD-LOOKING STATEMENTS ARE EXPRESSIONS AND BELIEFS OF DLP CAPITAL AND SHOULD NOT BE RELIED UPON. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE PERFORMANCE. NOTHING IN THIS IS A SOLICITATION OR OFFER OF SOLICITATION. ALL INVESTMENTS IN ANY DLP CAPITAL SPONSORED FUND ARE TO BE MADE AFTER A REVIEW OF THE PPM, OA, AND SUBSCRIPTION AGREEMENT. DLP CAPITAL IS NOT PROVIDING TAX ADVICE. CONSULT YOUR TAX AND LEGAL PROFESSIONAL BEFORE MAKING ANY INVESTMENT DECISIONS.