Rising interest rates, soaring home prices, and ballooning insurance costs are putting homeownership increasingly out of reach for many Americans.

30-year mortgage rates over the last two years have topped 7%—near the highest they’ve been in the 21st century.1 Meanwhile, nationwide home prices remain near all-time highs, up more than 50% from pre-pandemic levels.2 The expansion in less-visible carrying costs have further exacerbated the situation: homeowners now shell out more than $18,000 for maintenance, insurance, and property taxes per year—up 26% since Covid.3

It’s little surprise, then, that many would-be homeowners are choosing to stay on as renters—it’s simply cheaper to rent than to buy a home in every major U.S. metro.4

This financial reality is causing renter household formation to outpace homeowner household formation by nearly three-to-one.5 The third quarter of 2024, in particular, saw a 2.7% or 1.18 million increase in the number of renter households to a record 45.6 million.5 According to Redfin, this "was the second fastest pace since 2015, only trailing the first [quarter of 2024’s] 2.8% rate.”5

Where are these new renter households living?

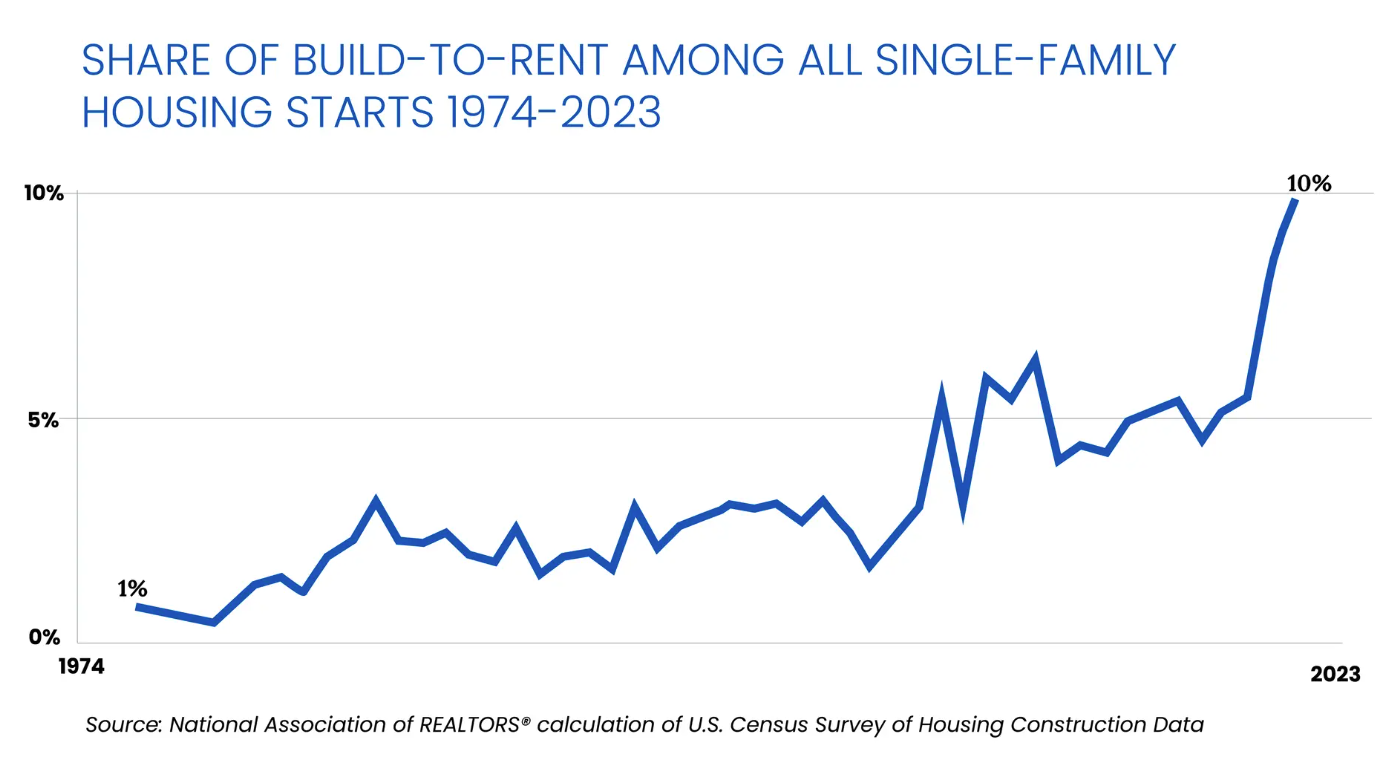

By and large, apartments remain popular: 47.1% of tenant households live in multifamily communities.6 But some alternatives, like build-to-rent single-family rentals, are becoming increasingly sought-after. This concept combines the privacy and living space afforded by a detached single-family home with the amenities, community, convenience, and hassle-free lifestyle provided by a professionally-managed apartment building. In other words, build-to-rent communities are like regular single-family neighborhoods—except they’re designed exclusively with renters in mind. The build-to-rent asset class itself is not new: they’ve been around since the 1980s, though they did not gain serious traction until after the Great Financial Crisis.7 Build-to-rent communities continued to rise in popularity following the pandemic, doubling from 5% of the single-family housing stock in 2021 to 10% of all homes by 2023.8

Where is the demand for build-to-rent coming from?

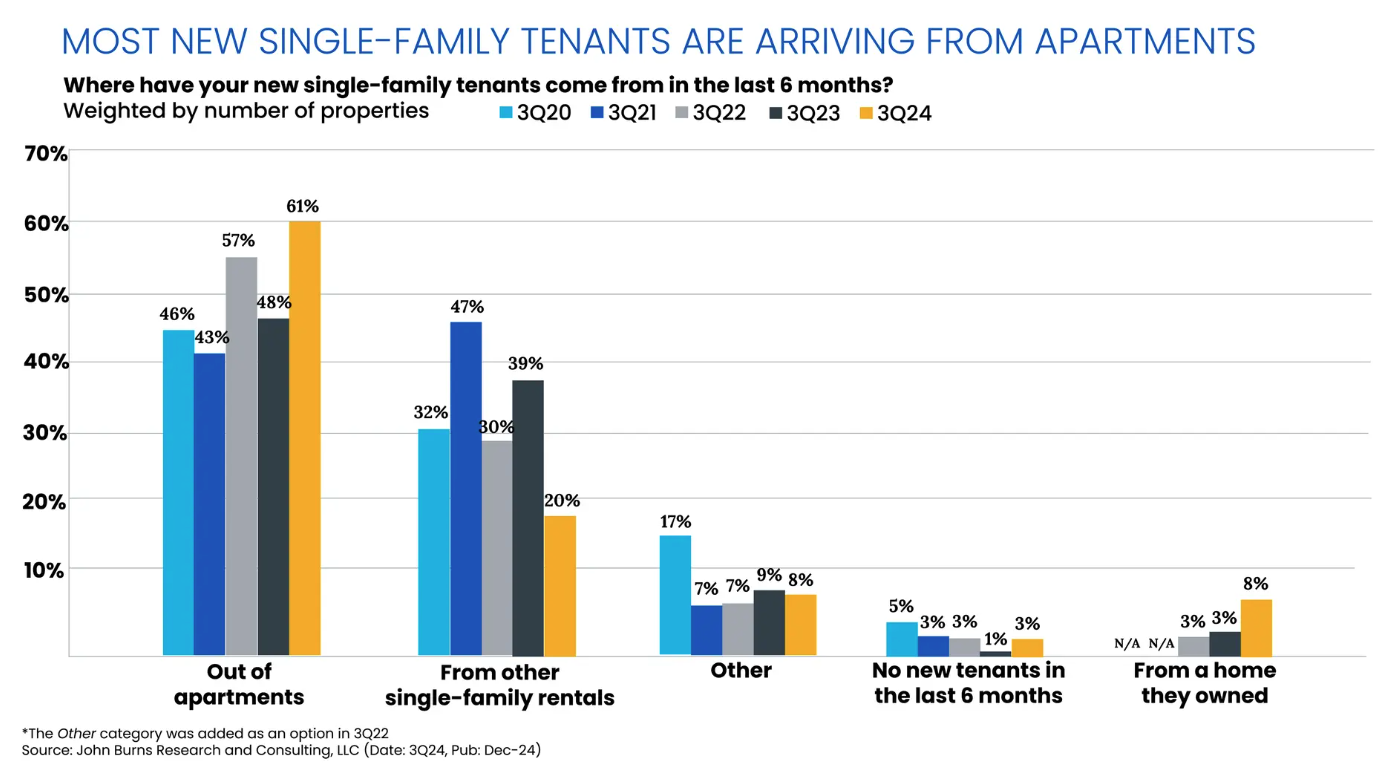

Interestingly, a sizable share of new build-to-rent tenants—about one-fifth of them as of Q3 2024—are trading existing single-family arrangements for amenity-rich, fully-managed build-to-rent communities.9 Still, the lion’s share of new build-to-rent tenants—nearly two-thirds of them in Q3 2024—are multifamily departees.

So why are tenants trading apartments for build-to-rent communities?

One explanation, given the ongoing lack of housing affordability, is that a sizable number of current tenants want the experience of homeownership without the hassles—and, most importantly, the financial burdens—that normally come with it. A recent poll conducted by SSRS and CNN lends credence to this claim: while 86% of surveyed renters expressed a desire to own a home, 54% believe they may never be able to afford to do so.10

Demographic trends may also be playing a role in rising build-to-rent demand. Between 2006 and 2016, the number of renter households with children grew by 1.9 million, while homeowner households with children declined by 3.6 million.11 Census data now reveal that 14.3 million households—about one-third of all renter households—have minor children, a proportion that could potentially remain on an upward trajectory if these past trends stay intact.11

For these families, build-to-rent housing could replicate the feel and comfort of owner-occupied single-family homes at a more affordable price. While build-to-rent homes are typically more expensive than multifamily rentals, the former often offers renter households the benefits of suburban life—a cul-de-sac, a front and backyard, and an attached garage—that are absent in the latter.

Build-to-rent communities could be attractive to investors as well. Strong (and growing) tenant demand could lead to higher occupancy rates, faster rent growth, and lower tenant turnover. The asset class’ unique niche in the market may likewise be a positive—it could enable investors to further diversify with private real estate and gain exposure to a new asset subclass. Besides, as a relatively under-the radar housing type, build-to-rent buyers may face less competition from other investors—a boon for developers and institutional investors who specialize in the asset class.

Curious to learn more about build-to-rent housing? Register for a live webinar to learn how the DLP Building Communities Fund—which targets a 8% preferred return and targeted annual net returns of 11–13%—can help you gain exposure to these thriving single-family communities today.