Sponsors use the terms “attainable” and “affordable” when referring to housing that’s targeted towards everyday, working American families.

These terms are sometimes used interchangeably in real estate, but they’re not the same. Their differences matter for accredited investors who invest in private real estate funds through real estate investment firms like DLP Capital.

What is attainable housing?

Attainable housing is market-rate single-family or multifamily housing designed for households that earn incomes roughly on par with the average in their area. Firms like DLP Capital focus on identifying, acquiring, and developing these attainable housing assets—an asset class that offers strong demand, stable returns, and resilience across economic cycles.

This housing segment caters to a stable and underserved tenant base of essential workers, such as teachers, nurses, and firefighters, who fall between subsidized programs and high-cost market-rate housing.

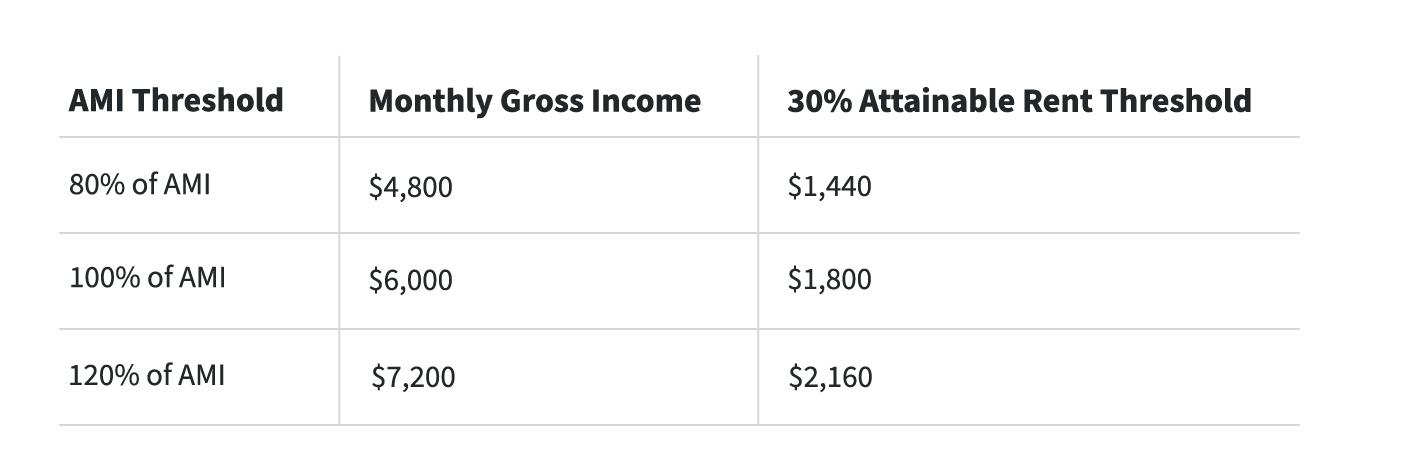

Attainable housing is priced to be affordable for renter households earning slightly below or above the area’s typical income. Housing is considered attainable when its rent does not exceed 30% of the Area Median Income (AMI), which is the 50th percentile gross income for households in a given location.1 However, attainable housing can target residents earning as little as 80% and as much as 120% of the AMI.1