As an accredited investor, you have the ability to invest in a broader set of assets than non-accredited investors.1 Like many high-net-worth individuals, however, you may not be very familiar with the investable universe beyond exchange-traded stocks and bonds.

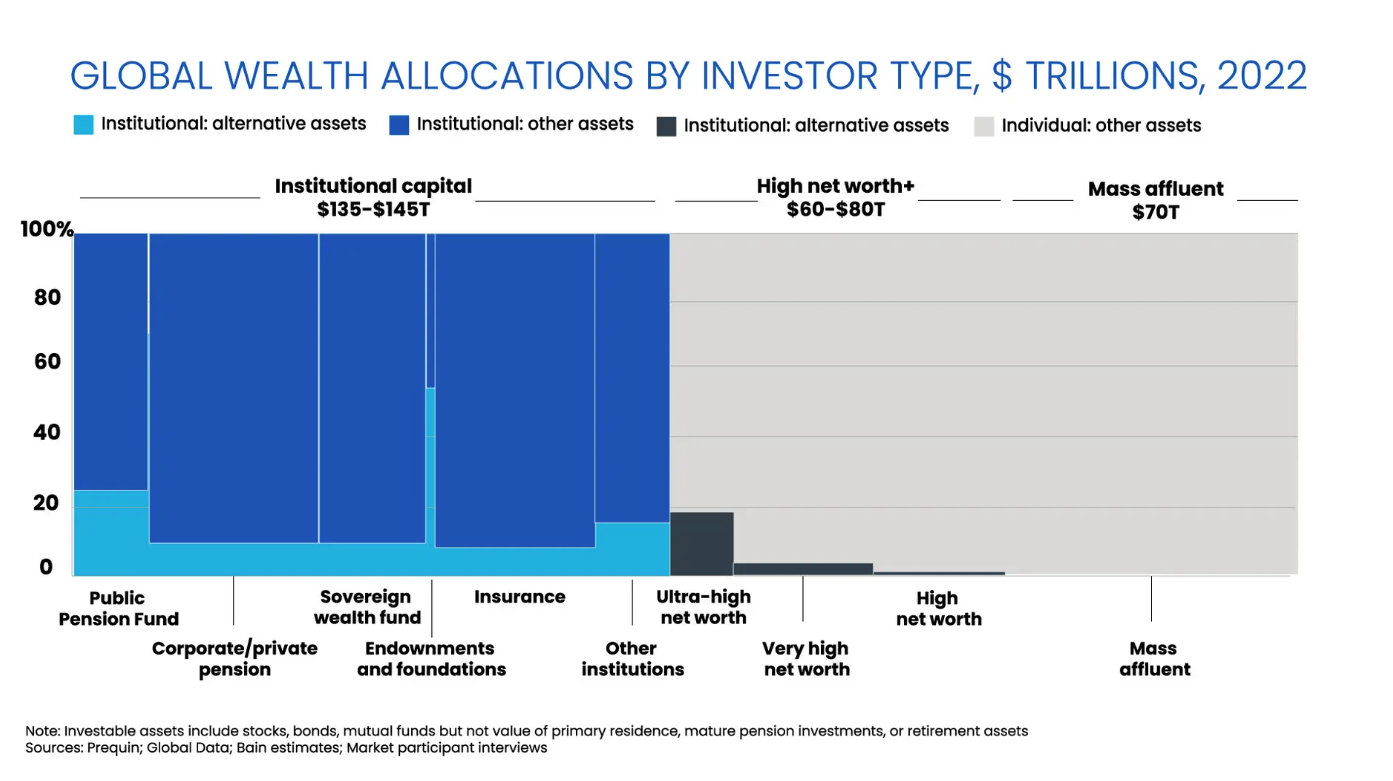

This is common: according to a 2022 study by management consulting firm Bain & Company, high-net-worth individuals—those with a net worth of $1 million or more—are “significantly under-allocated to alternatives, with only about 5% allocated in their portfolios.”2

But accredited investor appetite for private alternatives could be growing. Per Bain, “nearly 40% of high-net-worth individuals plan to increase their allocation to alternatives over the next three years”2

Private alternative investments—so termed because they are not listed on public exchanges like the New York Stock Exchange or the Nasdaq—refer to assets beyond “traditional” exchange-traded investments like stocks, bonds, and cash.

Many alternative asset classes are mostly or entirely non-public. For example, a report by Franklin Templeton reveals that "private real estate represents $10.3 trillion or 89% of the $11.6 trillion real estate market.” Publicly-traded real estate investment trusts, or public REITs, make up the remaining $1.3 trillion or 11% of the market.3

Interested in gaining exposure to this $10 trillion market—but don’t know where to start? In this article, we offer a beginner-friendly introduction to private real estate, discuss its benefits, and talk about when they could be worth considering.

What is private real estate?

Private real estate consists of debt or equity investments in income-generating multifamily rental housing, hotels and vacation rentals, offices, warehouses, data centers, or other commercial facilities.

Investing in private real estate outright can be prohibitively expensive; seven- or eight-figure deals are the norm, not the exception. One beginner-friendly and less capital-intensive way to gain exposure to private real estate—without having to engage in the day-to-day work of developing, acquiring, rehabilitating, leasing, managing, or disposing of properties—is to invest in a private real estate fund.

Private real estate funds: An option for beginners

When you invest in a private real estate fund, you do not have to play a role in operating or managing properties yourself. Instead, you are a passive investor: you invest capital and share in the potential profits and losses of the fund, which are generated when fund managers work with project sponsors to execute on business plans.

In effect, you’re entrusting your capital to your fund managers. Your money is invested in the asset class they specialize in, the deals they participate in, and the sponsors they partner with. You’re also trusting your fund management team to deliver to you a satisfactory return on investment by successfully executing on their business plan, which could involve ongoing property management, ground-up construction, asset repositionings, or other approaches.

The result, in practice, is that private real estate funds whose projects generate net operating income may target passive income for investors, sometimes in the form of a preferred return. In a true preferred return arrangement, you are first in line to receive distributions from the fund when it generates income. Once the preferred return is fully satisfied, you and your fund managers share proportionately in the fund’s profits.

The DLP Capital Preferred Credit Fund’s 9% targeted annual preferred return can potentially help you generate monthly income and offer you concurrent debt-side exposure to private multifamily real estate.

Why should beginners consider private real estate funds?

Private real estate is attractive because its return profile is historically less correlated to listed equities than publicly-traded REITs. Uncorrelated assets aid in portfolio diversification, help dampen drawdowns, and can improve risk-adjusted returns.4

Some private real estate funds may also be structured in ways that certain beginner investors may find more attractive than others. If you want the ability to access invested capital without committing upfront to long holding periods, you may wish to consider a private real estate fund that both features quarterly or annual liquidity and lacks minimum holding periods, which would restrict you from redeeming your capital if you no longer want to invest.

Your time horizon is also important. If you wish to invest for the long-term and do not want to redeploy capital once a time-limited fund reaches the end of its life, you may be best served by an evergreen fund, which is an open-end investment vehicle that does not have a termination date. Evergreen funds are also advantageous because fund managers do not have to race against the clock to deploy capital. Instead, managers can weather market downturns and hold out for deals that make sense for the fund’s strategy.

There are other benefits to private real estate funds, too:

- You don’t have to shop around for deals. Unlike a DIY approach or other private real estate offerings like syndicated deals, you don’t have to vet sponsors on a deal-by-deal basis. Instead, investments are selected by fund managers, who will continuously deploy capital into new deals on your behalf.

- You can evaluate a fund’s track record. Reputable fund managers will be transparent about a fund’s historical performance, which you can compare against other offerings as part of your investment selection process. In general, a lengthy track record of success may suggest (but in no way guarantees) that the fund’s managers are skilled in selecting deals and partnering with high-quality project sponsors.4

- You can gain exposure to multiple deals—rather than just one. By investing in a fund, you receive exposure to multiple projects simultaneously, allowing you to spread risk across a variety of business plans, geographies, and sponsors at once.

- You don’t have to be a real estate expert. It’s always good to know what you’re investing in and who you’re entrusting with your money—that’s the case even if you invest in a private real estate fund. But by no means do you need to be an industry expert to invest in private real estate. When you allocate to a fund, your fund managers will leverage their expertise to steward your capital. Some vertically-integrated investment companies will even have professionals skilled at creating value across construction, operations, dealmaking, and financing, which means that they can handle projects at all stages of the development process.

Backed by DLP Capital’s vertically-integrated team of in-house professionals, the DLP Lending Fund has a 10-year track record of generating double-digit net returns for private real estate investors.5